By Business Facilities Staff

By Business Facilities Staff

From the July/August 2022 Issue

From workforce to energy infrastructure and global conflicts to extreme weather, economic development organizations are called to keep the economic engines running amidst changing conditions. Even as the pandemic begins to recede, its impact on available workforce, supply chain, and related aspects are strong. Business leaders planning their next relocation or expansion consider traditional factors in site selection, with increased weight to resources like tech infrastructure, training programs, partnerships, renewable energy, and natural disasters.

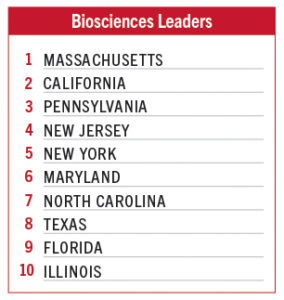

In the 2022 State Rankings portion of our 18th Annual Rankings Report, we look at traditional factors like Customized Workforce Training stars, while honing in with Tech Talent Pipeline leaders. At the city level, the rankings this year include Metros For Movers to shine a light on the widespread challenge of attracting talent. The global rankings look at several categories impacting site selection decisions across borders.

Business Facilities’ 18th Annual Rankings Report: State Rankings

NORTH CAROLINA: BEST BUSINESS CLIMATE

North Carolina is the top-ranked state in BF’s flagship Best Business Climate category. In 2022, the Tar Heel State has already announced significant investments from expanding companies—$104M from four companies within one week in May alone—as well as attracting new business, including those from the rapidly growing electric vehicle industry.

“North Carolina hit a new level for business attraction and retention over the past 12 months, and our ranking of the state for Best Business Climate recognizes what an increasing number of companies have recognized by locating or expanding there,” BF Editorial Director, Anne Cosgrove said.

In last year’s annual ranking, North Carolina captured second place in the Best Business Climate category. “The state’s move to the top of the leaderboard this year is a recognition of the success of a broad-based economic development approach from teams across the state,” added Cosgrove. “This ranking also looks beyond the sheer numbers, evaluating diversity of growth sectors, incentives, workforce development and training, and education partnerships.”

At the state level, the North Carolina Commerce (NC Commerce) and the Economic Development Partnership of North Carolina (EDPNC) are leading the economic development charge that has moved the state’s business climate to the head of the class.

Investment from the electric vehicle industry has been heating up across the U.S., and North Carolina is a location of choice for a growing number of companies in this space.

In March, Vietnam auto manufacturer VinFast chose North Carolina for its first North American automotive assembly and battery manufacturing plant. The company plans to create 7,500 jobs and invest up to $2 billion in phase 1 of the project at the Triangle Innovation Point megasite in Chatham County. This will be North Carolina’s first car manufacturing plant and is the largest economic development announcement in the state’s history.

“Automotive assembly plants are incredible engines for economic growth, due to the positive ripple effects they create across a region’s economy,” said North Carolina Commerce Secretary Machelle Baker Sanders. “I’m so pleased that VinFast has decided to launch their North America manufacturing operations from our state, and we’ll work hard to make sure they find the skilled workforce they’ll need to grow and thrive in North Carolina.”

“North Carolina’s strong commitments in building a clean energy economy, fighting climate change and reducing greenhouse gas emissions in transportation make it an ideal location for VinFast to develop its premium, smart and environmentally friendly EVs,” said Le Thi Thu Thuy, Vingroup Vice Chair and VinFast Global CEO.

The Vinfast news followed news toward the end of 2021 of more than $13 billion investment to the state from two EV operations, from Toyota and Arrival Automotive. Last December, in separate news, each company announced it has chosen to establish new EV battery plants in the North Carolina.

At its Greensboro-Randolph Megasite in Randolph County, Toyota will build its first North American battery manufacturing plant, creating at least 1,750 jobs. Toyota will invest $1.29 billion in the project, which will be led by a new venture between Toyota and Toyota Tsusho Corporation, the trading arm of the Toyota Group. The new venture company will be known as Toyota Battery Manufacturing, North Carolina (TBMNC).

“The future of mobility is electrification and the Greensboro-Randolph Megasite is the ideal location to make that future a reality,” said Ted Ogawa, CEO of Toyota Motor North America. “North Carolina offers the right conditions for this investment, including the infrastructure, high-quality education system, access to a diverse and skilled workforce, and a welcoming environment for doing business.”

In the distribution sector, the state has also attracted a steady stream of projects, including Amazon and Macy’s in recent months.

Amazon is building a 1.3 million-square-foot fulfillment facility in Cumberland County, NC. The new distribution operation will create more than 500 full-time jobs with additional part-time opportunities. Located on 94 acres in the Military Business Park, the facility is expected to begin receiving products into the company’s fulfillment network and ready them for shipment to consumers in 2023.

Factors influencing Amazon’s selection of Cumberland County include its skilled workforce and solid labor market, enhanced by many of the 7,000 service members transitioning from Fort Bragg each year. Additionally, the county’s centralized geographic location and access to major interstates were selling points.

This is the second project the company has announced in Cumberland County. In May 2021, Amazon announced a new last-mile facility, establishing the company’s operations in the community. Currently under construction, the project will complement this new distribution center.

In the spring, retailer Macy’s announced it will build its first fully automated distribution center in China Grove, NC located in Rowan County. The company will invest $584.3 million for the project which has a goal of 2,800 new jobs. One of the largest e-commerce businesses in the retail industry, Macy’s 1.4 million-square-foot facility will support 30% of the company’s e-commerce fulfillment.

The investment announcements out of North Carolina in 2022 reflect growing momentum from economic news from the state last year. In one of the biggest tech industry announcements in 2021, Apple announced that April its choosing the Tar Heel State as the location of its first East Coast campus, a $1 billion project that will create 3,000 new jobs with an average annual salary of $185,000. These jobs will be primarily in artificial intelligence, machine learning and software engineering, according to information provided by the Department of Commerce and the EIC.

VIRGINIA TOPS FOR TECH TALENT

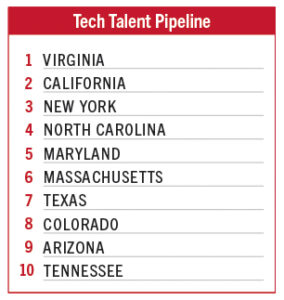

For the second year, Virginia ranked first in both Tech Talent Pipeline and Cybersecurity categories.

Focused on a state’s strategy and results related to workforce availability for technology-related jobs across all industries, the Tech Talent Pipeline category evaluates investments in developing tech talent, STEM-oriented education programs and partnerships, innovative tools, and the results a program delivers.

The Cybersecurity category evaluated locations with an eye on the concentration of tech jobs, computer science graduate programs, and partnerships between higher education and government programs.

“In this second year of BF’s Tech Talent Pipeline ranking, Virginia stood out again with the investments and partnerships the state and other entities have forged to meet the workforce needs of so many businesses today,” said Cosgrove. “We were impressed with the accomplishments that the state’s Tech Talent Investment Program continued to deliver in 2021.”

Earlier this year, Virginia was recognized as a Business Facilities 2021 State of the Year for its competitive business climate.

As part of the drive to expand its tech talent, Virginia has a strong focus on skilled cybersecurity workers. (The state is home to Cyberseek, the second largest cybersecurity industry in the country) In this year’s rankings, BF recognizes initiatives in that sphere, including the close to 50 colleges and universities that have established cyber degrees. Virginia is also home to 23 NSA/DHS Centers of Academic Excellence (CAE) in cybersecurity.

Around the state, tech talent is inherent to the area with Virginia’s world-class higher education institutions and proximity to federal government agencies and resources. And the Virginia Talent Accelerator Program, launched in 2019 by the Virginia Economic Development Partnership (VEDP), is an alternative to traditional recruitment and training incentive programs and accelerates facility start-ups through the direct delivery of recruitment and training services that are customized to a company’s jobs and processes.

The Tech Talent Investment Program from VEDP is aimed square at creating and maintaining the state’s tech talent. It’s no surprise that the number jobs requiring tech skills will continue to expand, and Virginia’s program coupled with the region’s access to higher education and government entities makes it a winning strategic initiative.

Over the past 12 months, company announcements on investing in Virginia highlight the tech talent these firms recognize as an asset in the state.

In December 2021, CoStar Group, Inc., provider of real estate information, analytics, and online marketplaces, announced plans to invest more than $460 million to expand in Richmond. CoStar plans to establish a corporate campus that will include sales, marketing, software development, customer service, and support functions on four acres adjacent to its current facility, which serves as the headquarters for research and data analytics.

“Richmond is a growing community with access to a deep pool of diverse, highly-skilled workers, a vibrant culture of innovation and a wonderful quality of life for our existing and future employees,” said Andy Florance, Founder and Chief Executive Officer of CoStar Group. “The strong partnerships we have established with the Commonwealth of Virginia, the City of Richmond, and institutions of higher education such as VCU, will be critical for our continued growth. Virginia, Richmond, and Costar Group all have bright futures ahead, and we are excited to grow together.”

In May, Boeing announced its Arlington, VA campus will now serve as the company’s global headquarters. Employees in the region support various corporate functions and specialize in advanced airplane development and autonomous systems. In addition to designating Northern Virginia as its new headquarters, Boeing plans to develop a research and technology hub in the area to harness and attract engineering and technical capabilities.

“We are excited to build on our foundation here in Northern Virginia. The region makes strategic sense for our global headquarters given its proximity to our customers and stakeholders, and its access to world-class engineering and technical talent,” said Boeing President and Chief Executive Officer Dave Calhoun.

And in June, Raytheon Technologies chose Arlington, VA as the new location of its global headquarters. The Virginia location increases Raytheon’s agility in supporting U.S. government and commercial aerospace customers and serves to reinforce partnerships that will progress innovative technologies to advance the industry. Nearby Washington, DC also serves as a convenient travel hub for the company’s global customers and employees.

![]()

“The location increases agility in supporting U.S. government and commercial aerospace customers and serves to reinforce partnerships that will progress innovative technologies to advance the industry,” Raytheon said in a statement at the time of its announcement.

In April, Lorton, VA-based Bode Technology announced a $2 million investment to expand its DNA testing services lab in Fairfax County, VA. The provider of forensic services plans to hire additional senior and entry-level laboratory technicians, forensic science professionals, and other business support roles, creating more than 70 new jobs.

Said Mike Cariola, CEO of Bode Technology, “To help fight crime, we need to hire the most talented scientists in the world, and the universities in Virginia and surrounding areas have been essential to our success. Demand for our services has increased, and today we are recruiting talented scientists from across the country to join us here in Fairfax County so that we can continue our mission.”

LOUISIANA LEADS: CUSTOMIZED WORKFORCE TRAINING

This year’s rankings sees Louisiana retaining its place as the top-ranked state for Customized Workforce Training for the 13th-consecutive year in Business Facilities’ 18th Annual Rankings Report. The state is ranked first for this innovative and agile LED FastStart program, administered by Louisiana Economic Development.

“The state’s LED FastStart program continued its strong push toward equipping its workforce with the skills being sought by new and expanding companies. In 2021, the program reported 6,000+ hours of training for 32 firms in the state to provide the skilled workers to hit the ground running for business,” said Cosgrove.

Especially in the current climate where companies of all shapes and sizes are looking for skilled and willing to work employees, a custom training program can be the linchpin in a firm’s decision of whether or not to select a particular location. This type of program is also a linchpin in supporting the company’s success in a new location or one where the firm has recently expanded.

The LED Fast Start Program, the state’s flagship workforce development initiative, is based on that full life-cycle of training talent for a company that creates jobs in the state. The LED FastStart framework is “Recruit. Train. Sustain”.

The recruiting aspect uses a next-generation workforce hiring platform that allows job seekers to interact with hiring companies in dynamic ways. Using company landing pages, an integrated application tracking system, hyper customization, and sophisticated data analysis, the platform helps company recruiters match candidates with the right job opportunities. LED Individualizing recruitment ensures the company and the candidate both have a good experience, increasing the likelihood of a new hire becoming a long-term employee. Other recruiting aspects include virtual job fairs and targeted recruiting.

Training is customized for the company and jobs that need to be filled. Sustain includes involvement with the education system, including investment in higher education to advance curricula and training in software, digital and IT services, advanced manufacturing, and STEM-related disciplines.

The LED FastStart is designed to be agile in order to respond to individual companies’ needs—or when an external force, such as a worldwide pandemic, comes into play.

When COVID-19 challenged in-person processes, the LED FastStart team rapidly transitioned project-specific training to remote delivery formats such as webinars and virtual classes. The LED FastStart eLearning team converted many traditional instructor-led training courses to webinar format, including courses on Talent Management and Quality Programs. The eLearning team developed enhanced processes for virtual walkthroughs with subject matter experts, employing robust virtual review sessions of training content.

TEXAS, CALIFORNIA, ARIZONA SEMICONDUCTOR LEADERS

The COVID-19 pandemic put into sharp focus the lack of semiconductor manufacturing supply in North America. As technology that utilize semiconductors were in high demand during the pandemic, when society as a whole interacted remotely for more than a year, the widespread global semiconductor shortage developed. As the industry responds in earnest to ramp up production in North America, locations across the U.S. are emerging as hot spots for semiconductor ecosystems.

The Semiconductor Industry Association published its 2021 State of the U.S. Semiconductor Industry: “The shortage increased awareness of the importance of America’s semiconductor supply chains. Although geographic specialization in the global chip supply chain has enabled tremendous growth and innovation in the industry, vulnerabilities in the supply chain have emerged in recent years. For example, in 2019, 100% of the world’s most advanced logic semiconductors (< 10 nm) were produced overseas.”

Texas is recognized in the leading spot in this year’s Semiconductors ranking, not only for existing ecosystems to support R&D and manufacturing, but for notable industry investment. California and Arizona took the second and third ranking.

Most notable in the past 12 months is the decision of Samsung Electronics, Co., Ltd. to build its new semiconductor plant in Taylor, TX. When announced in December 2021, the $17 billion investment is the largest foreign direct investment in Texas on record.

The new manufacturing facility will produce advanced logic chips that will power next-generation devices for applications such as mobile, 5G, high-performance computing (HPC), and artificial intelligence (AI).

After reviewing multiple locations within the U.S. for a potential manufacturing site, the decision to invest in Taylor was based on multiple factors, including the local semiconductor ecosystem, infrastructure stability, local government support, and community development opportunities. In particular, the proximity to Samsung’s current manufacturing site in Austin, about 15 miles southwest of Taylor, allows the two locations to share the necessary infrastructure and resources.

“Samsung Austin Semiconductor has been proud to call Texas home for more than 25 years,” said Dr. Sang Sup Jeong, President of Samsung Austin Semiconductor. “We are excited about our growth and future opportunities in Central Texas and appreciate the support from all Central Texas leaders.”

The project will create over 2,000 high-tech jobs, thousands of indirect jobs, and a minimum of 6,500 construction jobs. Construction will begin in early 2022 with a target of production start in the second half of 2024. .

Also in 2021, Texas Instruments Incorporated announced it would build a new 300-millimeter semiconductor wafer fabrication plants (fabs) in Sherman, TX. The North Texas site has the potential for up to four fabrication plants to meet demand over time, as semiconductor growth in electronics, particularly in the industrial and automotive markets, is expected to continue well into the future. Construction of the first and second fabs is set to begin in 2022.

“TI’s future analog and embedded processing 300-mm fabs at the Sherman site are part of our long-term capacity planning to continue to strengthen our manufacturing and technology competitive advantage and support our customers’ demand in the coming decades,” said Rich Templeton, Texas Instruments’ Chairman, President and Chief Executive Officer. “Our commitment to North Texas spans more than 90 years, and this decision is a testament to our strong partnership and investment in the Sherman community.”

According to the SIA 2021 Annual Report, TX had 15 wafer fabrication plants (fabs) in the state, and 16% of the U.S. workforce for the industry in 2020.

MANUFACTURING IN THE MIDWEST MOVES

In this year’s Manufacturing (Jobs) ranking, Wisconsin led the list. A bevy of manufacturing investments are keeping the state humming with production activity. In May, Milwaukee Tool announced plans to create 1,000 new jobs in Wisconsin. The Brookfield-based tool manufacturer will invest $206 million at nine locations across the state. Wisconsin will support the company’s expansion with up to $22.5 million in additional performance-based tax credits.

This newest investment by Milwaukee Tools in Wisconsin will help support the expansion of its existing research and development facilities, infrastructure needs, and equipment. Of the 1,000 jobs the company has committed to creating, many will be critical engineering and technical roles needed to support the rapidly advancing technologies harnessed in their products.

In another multi-location investment in Wisconsin, Merz North America, Inc. is expanding its facilities in Sturtevant and Franksville. The North Carolina-based aesthetics and neurotoxin manufacturer will invest $8 million and create 35 jobs over the next three years.

In Fall 2021, Generac announced it would expand its presence in Wisconsin by investing $53 million in its facilities across the state and creating more than 700 new jobs. When the global manufacturer of energy technology solutions and other power products meets its capital investment and job creation goals by 2024, it will receive additional Enterprise Zone tax credits authorized by the Wisconsin Economic Development Corporation (WEDC).

Earlier this year, Casting Cleaning Resources, an Indiana-based manufacturer that serves the foundry industry, is expanding its operations to Menomonee Falls, WI. The company provides post-mold cleaning of iron castings to manufacturers in Iowa, Illinois, and South Carolina and needed to expand its operations to meet industry demand.

The southern Wisconsin location brings Casting Cleaning Resources closer to its customer base and allows the company to service the foundry industry in a larger capacity than they were able to previously.

“Wisconsin and the greater Milwaukee area are the perfect fit to go along with our company and operations. The state not only has a strong background in manufacturing but also offers attractive incentives for new businesses coming to Wisconsin. It was a very easy decision to make to expand operations here,” stated Billy Robinson, Controller at Casting Cleaning Resources.

WEDC is supporting the project by authorizing up to $200,000 in performance-based tax credits over the next three years if the company creates at least 39 new jobs and invests at least $4 million in capital expenditures. The actual amount of tax credits Casting Cleaning Resources will receive is contingent on the number of jobs created and the capital invested in the project.

In our Manufacturing (Output) ranking, based on percent of state GDP, Indiana was number one; the state was second to Wisconsin in the Manufacturing (Jobs) leaderboard.

In March, Hello Nature, manufacturer of organic fertilizers, biostimulants, and microbials, has partnered with 6th-generation Indiana business MPS Egg Farms. The joint venture, dubbed Bionutrients, will invest nearly $50 million in Wabash, IN to build and operate a specialty fertilizer manufacturing facility that will employ 46 people.

Bionutrients will combine high-quality raw materials and cutting-edge technologies. The partners will break ground on two facilities totaling nearly 300,000 square feet this spring, with the facility fully operationally in the summer of 2023. The facility will expand Hello Nature’s Indiana presence and complements its two facilities in Anderson.

Also in Indiana, earlier this year Guardian Bikes announced it would build a highly automated factory to move production of its safety-focused kids’ bikes to the U.S.

Guardian selected a site at the Freeman Field Industrial Park in Seymour, IN, where the company expects to invest nearly $7 million and employ 100 workers by 2026.

Said Brian Riley, CEO and Co-Founder of Guardian Bikes, “By moving production of our bikes to the USA, and then fulfilling our bikes straight from our U.S. factory floor direct to your door, we begin to create a sustainable supply chain system, which allows us to not only be a Guardian for the kids in your family with the safest bikes available for them, but also be a Guardian for the future of the planet they will grow up on.”

Founded in Irvine, CA, Guardian moved to Austin, TX in 2020. The company’s transition to U.S. production will happen in several phases: Phase 1 will involve final assembly of parts and frames, which was slated to begin in June 2022.

Continue reading Business Facilities’ 18th Annual Rankings Report:

Metro and Global Rankings

![[VIDEO] Get More for Your Business in Ardmore. Oklahoma](https://businessfacilities.com/wp-content/uploads/2024/02/maxresdefault-324x160.jpg)