On August 12, the U.S. House of Representatives voted on and passed The Inflation Reduction Act of 2022, a broad-reaching piece of legislation purported to combat inflation, invest in domestic energy production and manufacturing, help to reduce carbon emissions, address Medicare and the Affordable. Care Act, and affects several tax items and IRS staffing. This passage followed the August 7 U.S. Senate vote that moved the Act forward, under the budget reconciliation process.

Since being introduced to the public in late July, The Inflation Reduction Act of 2022 has been met with varying reactions. It is expected to be signed into law this week by President Biden.

Despite the name of this legislation, a primary focus is also the impact of its energy and climate change-related aspects. Groups and individuals focused on being proponents for renewable energy infrastructure and systems and reduction of carbon emissions are highlighting the ways this legislation will help to facilitate the development of renewable energy while decreasing carbon emissions. There are also groups and businesses focused on the other side of the coin, where the provisions in the legislation are seen to be possible hindrances to economic growth and economic development around the United States.

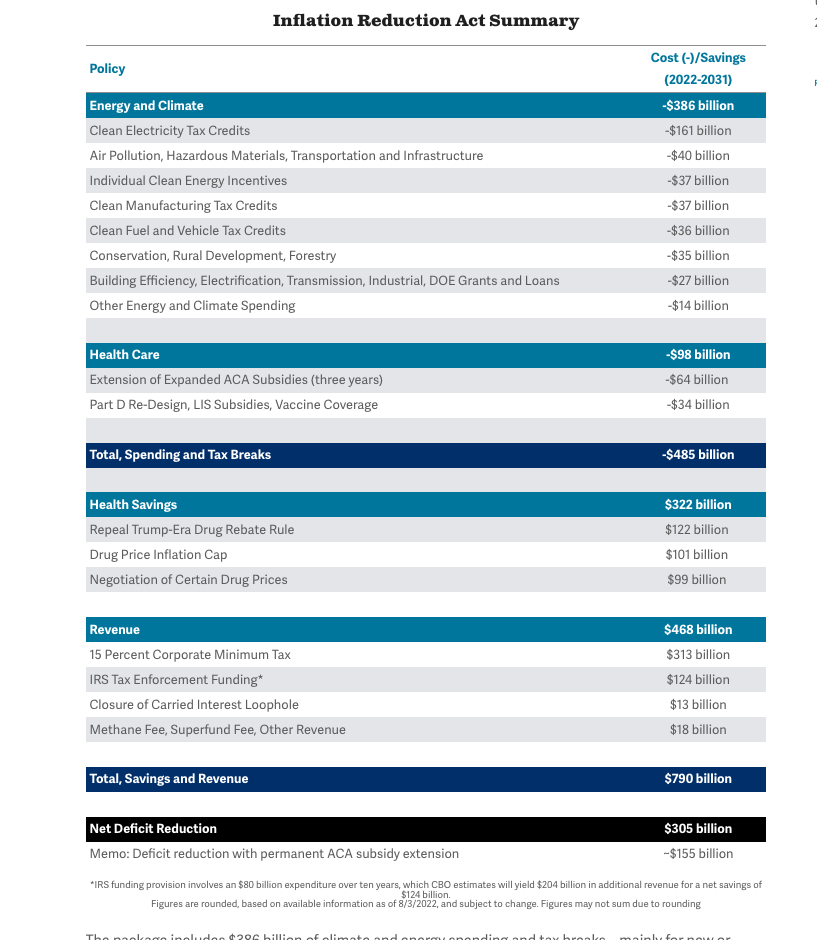

According to the August 11 summary document from the democrats.senate.gov website:

The Inflation Reduction Act of 2022 will make a historic down payment on deficit reduction to fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by roughly 40% by 2030. The bill will also finally allow Medicare to negotiate for prescription drug prices and extend the expanded Affordable Care Act program for three years, through 2025. Additionally, the agreement calls for comprehensive Permitting reform legislation to be passed before the end of the fiscal year. Permitting reform is essential to unlocking domestic energy and transmission projects, which will lower costs for consumers and help us meet our long-term emissions goals.

Following is a round up of statements and observations from industry associations, government groups, and private entities. To share additional statements and observations on this topic, send an e-mail to the Business Facilities editorial department.

Committee for a Responsible Federal Budget

The CRFB released the below figures on July 28; the below is updated August 11.

National Association of Manufacturers

Following the release of the text of the Inflation Reduction Act, NAM President and CEO Jay Timmons released the following statement on August 6:

“The NAM remains staunchly opposed to the IRA. It increases taxes on manufacturers in America, undermining our competitiveness while we are facing harsh economic headwinds such as supply chain disruptions and the highest rate of inflation in decades.

“We appreciate that the ‘book tax’ has been revised to reflect the importance of job-creating investments in machinery and equipment. But that is insufficient. These new taxes will still deliver a blow to our industry’s ability to raise wages, hire workers and invest in our communities. In addition, the proposed direct negotiations over prescription drugs are a form of price setting and antithetical to the open marketplace of the Medicare Part D program. Pursuing price control policies could threaten future innovation and cures.

“Any desirable elements of this bill can and should be pursued as standalone legislation. As a whole, the bill simply does not position our industry or our country for future growth or global economic leadership and competitiveness, so we urge all lawmakers to stand with us and reject it.”

Penn Wharton Budget Model

- PWBM estimates that the Senate-Passed Inflation Reduction Act, as written, would reduce cumulative deficits by $264 billion over the 10-year budget window.

- The Act would have no meaningful effect on inflation in the near term but would reduce inflation by around 0.1 percentage points by the middle of the first decade. These point estimates, however, are not statistically different from zero, indicating a low level of confidence that the legislation would have any measurable impact on inflation.

- Relative to current law, the Act would slightly reduce GDP in the first decade while slightly increasing GDP by 2050. These estimates include the impact of debt reduction, carbon reduction, and tax incentives on investments and working hours.

- Most, but not all, of the tax increases fall on higher income households. However, future generations, including higher-income households, gain from the improved economy, including a reduction in carbon emissions.

U.S. Green Building Council

Ahead of the House’s vote on the Inflation Reduction Act, the U.S. Green Building Council released the following statement from interim president and CEO Peter Templeton on August 10: “The House of Representatives has a chance to make history by acting to protect the future. The Inflation Reduction Act would put in place the most critical and consequential climate policies we have ever seen, and it would do so while reducing energy costs for American families and businesses and shoring up our energy security with a more diversified and reliable energy sector. The U.S. Green Building Council urges members of the House of Representatives to swiftly pass the bill and send it to President Biden to sign into law. At USGBC, we are committed to transforming how our buildings are designed, constructed and operated. Green buildings and homes are essential to meeting our climate goals and reducing the financial burden on hardworking Americans. This bill includes billions of dollars in investments in tax incentives for home and building owners, public building upgrades, green building improvements to affordable housing, and low embodied carbon construction materials. USGBC is proud to have advocated for many of these provisions in recent years and to have rallied the support of thousands of business and community leaders, lawmakers and taxpayers behind them. Achieving policy success is a long game that requires persistent advocacy to seize windows of opportunity when they open. This is our window to drive meaningful climate action that benefits American families, jobs and communities.The act will have a profound impact on communities across the country and will be marked in our history as a turning point in our climate fight. We look forward to celebrating House passage and seeing the President sign the bill in the coming days and collaborating with our members and stakeholders to implement the new law.”

![[VIDEO] Get More for Your Business in Ardmore. Oklahoma](https://businessfacilities.com/wp-content/uploads/2024/02/maxresdefault-324x160.jpg)